Module: Commission & Bonuses

This section allows the Admin to configure commission and bonus settings and also monthly target. The values defined here will be used for calculating commission and bonus payouts during payroll processing.

1. PT Bonus

dsfafPT Bonus refers to Personal Training Bonus. Sales employee that successfully sold Personal Training sessions will refer additional bonuses according to Sales Threshold configured here.

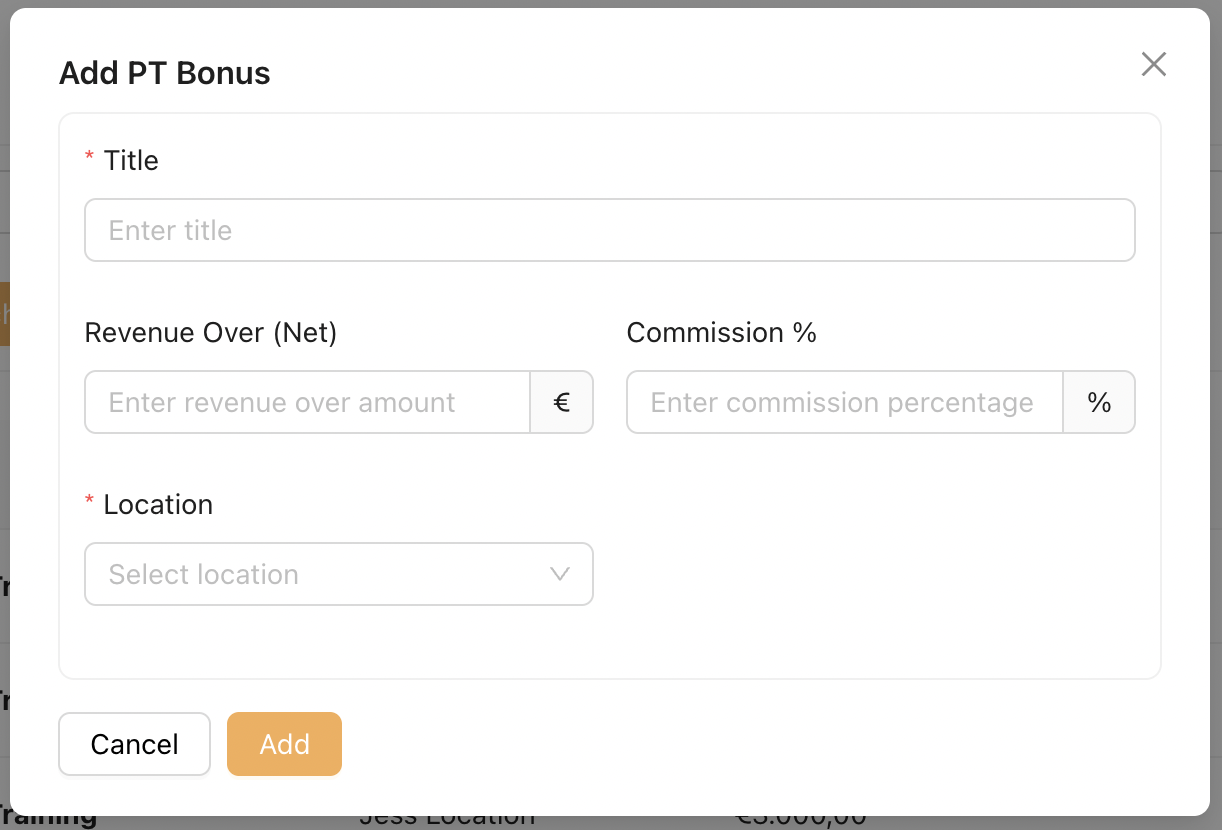

Title : Enter a name for this PT bonus tier or range (e.g. PT Bonus – Level 1).

Revenue Over (Net) : The minimum sales amount required to qualify for this bonus tier.

Net refers to the amount after tax deduction.

Commission % : The percentage of commission awarded when the sales amount exceeds the defined revenue threshold.

Location : Select the location(s) where this PT bonus structure applies.

Employees assigned to these locations will follow this bonus rule.

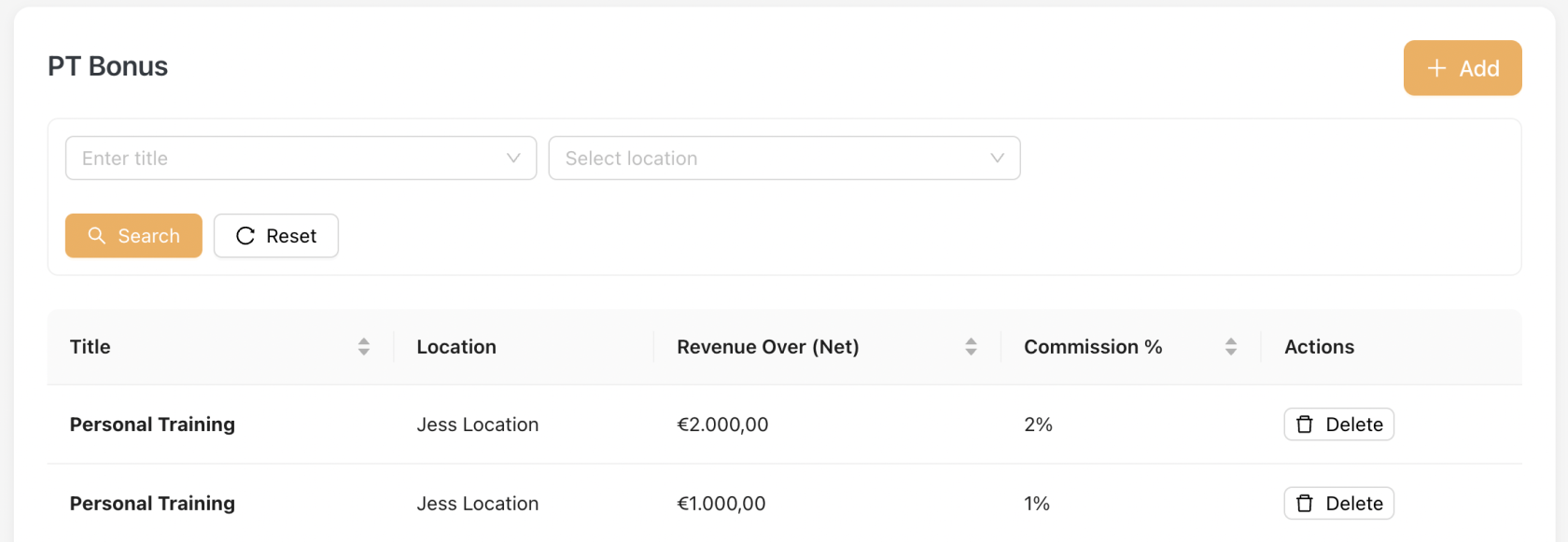

Below shows how the bonus threshold is displayed on listing :

An example of PT Bonus Calculation

Gross Sale = €2,300

Tax = 19%

Net Sale = €2,300 - 19% = €1,863

Step 1: Determine threshold → €1,863 ≥ €1,000, so 1% commission applies.

Step 2: Apply formula →PT Bonus = 1,863 × 1% = €18.63PT Bonus : €18.63

2. Mini-Jobber Bonus

Every Mini-Jobber is entitled to Mini-Jobber Bonus monthly. Mini-Jobber Bonus calculation